The Mackay Waterfront is set to be a game changer for the region.

The Mackay Waterfront will establish a range of culturally vibrant, accessible, liveable, and attractive places that supports growth, investment, and development of Mackay.

The precincts will develop into an expression of mixed-use live, work and play waterfront environment that meets the need of current and future residents and visitors, whilst celebrating its regional and river city focus, heritage assets, climate, and local identity.

Explore our current projects

Explore our region

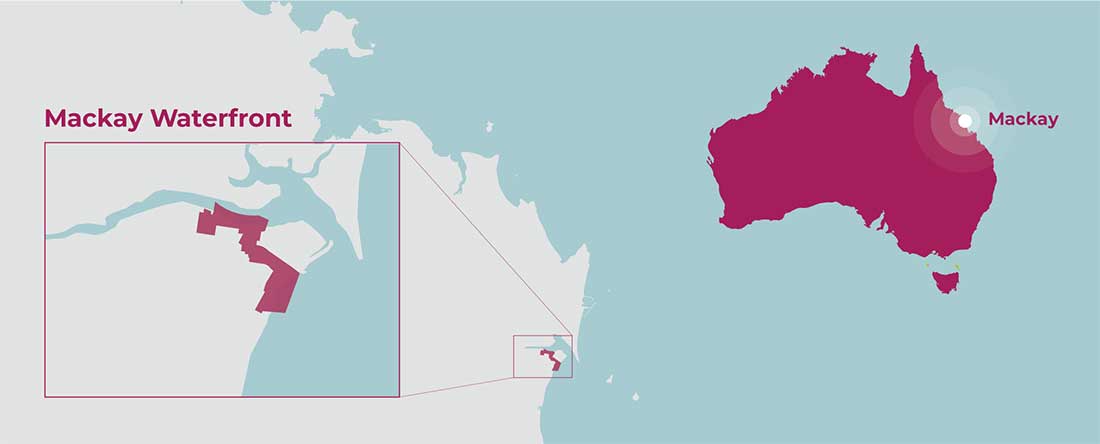

Located in the heart of the Mackay Region and surrounded by the stunning waterfronts of the Pioneer River and Binnington Esplanade plus the lush greenery of Queen’s Park, the Mackay Waterfront provides endless opportunities.